The Bitcoin Scene in New Zealand in 2023

What is the Bitcoin scene like in New Zealand? Here’s the definitive summary of Bitcoin in New Zealand in 2023 - Bitcoin adoption, meetups, events, companies, media, personalities and regulation. It’s all here, including a summary of opportunities and headwinds for Bitcoin in Aotearoa, the Land of the Long White Cloud.

Article Contents & Quick Links

- Intro to the New Zealand Economy

- Inflation in New Zealand

- Bitcoin Adoption in New Zealand

- Bitcoin Events & Meetups in New Zealand

- Bitcoin Companies in New Zealand

- Bitcoin Media in New Zealand

- Kiwi Bitcoin Personalities

- Government Regulations & Initiatives

- Community Initiatives

- Opportunities & Headwinds for Bitcoin in New Zealand

General Info & Economy

In 2023, New Zealand’s population is around 5.2 million people, which is similar to that of Ireland, Costa Rica or Norway. Compared with major cities around the world, New Zealand has less people than Dallas, Singapore, Fukuoka or Barcelona.

New Zealand GDP and Economy

The New Zealand economy is made up of the following main sectors:

- Growing, catching or producing food & drink and sending it overseas

- Chopping down or digging up stuff and sending it overseas

- Showing wealthy visitors from overseas around the country and charging them big bucks to jump off bridges, traverse white water rapids or take a photo with a sheep.

- A few other semi-serious industries like tech, healthcare and education.

In 2022, New Zealand’s GDP was approximately USD $247 billion, which puts us in the same ballpark as Greece, Peru and Qatar. This comes in at about USD$48,000 per capita, similar to Belgium, Germany and Hong Kong.

For reference, in 2023 the US has a GDP of USD $25 trillion ($76,000 per capita), the United Kingdom USD $3 trillion ($46,000 per capita), Japan $4.2 trillion ($33,800 per capita) and Australia $1.7 trillion ($64,000 per capita).

Sourced from our good friends at the World Bank.

Debt & Money Supply in New Zealand

As a modern liberal economy running the Keynesian playbook, even though we’re a small country we’ve got debt coming out our eyeballs.

At USD $81 billion, New Zealand government debt is moderate (42% of GDP), especially when we compare to the creaking giants of the US (130%) and Japan (250%), we’re at a much more manageable level.

But like all countries playing the fiat game, we’re increasing that debt fast: in 2013 it was under USD $50 billion. That’s how the fiat game works, inflate the nominal size of the economy with debt backed lending so you can increase the debt without anyone noticing, look ma, it’s only grown 3-4% of GDP and look at all those other basket cases around the world, we’re sweet!

But when Private Debt is thrown into the mix it gets interesting, New Zealand’s Private Debt (mortgages, student loans, hire purchases, car loans, credit cards) was 140% of GDP in March 2023. This puts us in the top echelon of Private Debt to GDP Ratios.

Source: CEIC Data

Our Government is running a deficit of NZD $9.4 billion (USD $5.7 billion) for 2023, over $2 billion more than forecast! This is our previous Finance Minister on the day he told the country we’ve just added 10% to our national debt in one year but we should be happy, because GDP is up!

The previous NZ Finance Minister looking very pleased with himself. Fiat incentives.

So we’re living beyond our means, as a country and individual households.

Inflation in New Zealand

As Bitcoiners, we all know there are different ways to measure inflation and they are not usually the same metrics the politicians and mainstream news media parade in front of us.

Consumer Price Inflation (CPI)

Prices are biting in New Zealand, anyone will tell you. The CPI in New Zealand topped out at about 7.3% in mid 2022 and is sitting at around 6% in Q4 2023. But ask anyone, there’s a cost of living crisis here right now, even households with good incomes are feeling it.

Food price inflation is at around 9% for the last 12 months and a whopping 28% over the last 10 years. How does this happen in a food producing nation like New Zealand? Fiat monetary debasement and Keynesian economics, that’s how.

Source: Statistics New Zealand

As a net importer of petroleum, we’re at the whim of international markets and geo-political macro moves to determine whether or not we get to enjoy the classic Kiwi summer at the beach, and according to Shanelle here, the Kiwi beach summer is off the cards due to high petrol prices.

House Price Inflation

House prices in New Zealand have gone from affordable for a single income family to unaffordable for most of the working population in the last two generations. A combination of an expansionary monetary base and favourable tax treatment for property owners has taken the Kiwi dream out of reach of most now in a few short decades. Nice one Stu! In 1971, the median house in New Zealand cost 4.5 times the median household income. In 2021 it was 12 times and as a result we’re seeing home ownership levels drop, along with all the associated social problems.

My parents bought a house in 1970 for $10,000, which was the median house price that year. In 2023 that same house would cost you NZD $879,000, representing a 98.9% decrease in purchasing power for your money over that time.

How did I calculate this? Using a handy calculator generously provided by the New Zealand Government Statistics Department that even calculates the decrease in purchasing power of their own fiat currency. Funded with your tax dollars too, just to rub it in.

New Zealand House Prices in Bitcoin

House prices in New Zealand are a joke if you're on the fiat treadmill. It is mathematically impossible now to work in a regular job, save enough for a deposit and pay it off before retirement.

But if you’re pricing houses in Bitcoin it looks a little different:

Houses in New Zealand are getting cheaper, but only if you hold Bitcoin.

Monetary Inflation in New Zealand

New Zealand printed a bunch of money in 2020 (NZD $53 billion) to finance Covid handouts, this was about 15% of the M2 supply at the time but our monetary base had been increasing slowly but surely for the last 20 years up to that point anyway. New Zealand was actually the first country in the world to introduce an official inflation target in 1989.

An analogy I like to use to explain the monetary debasement to Kiwis is that for every $1 you had in 2020 the government just took 15% of its purchasing power away from you without even asking (and probably without you even realizing at the time, but I’ll bet you do now!)

Government surpluses are a thing of the past now, (last one was in 2017) we’re running deficits, have low household savings and a trade deficit, so the trends aren’t great. But as we always like to say in New Zealand - it’s not as bad as in many other places.

Bitcoin Adoption in New Zealand

So what is the state of Bitcoin adoption in New Zealand? Even after recent monetary debasement and inflation, it is hard to convince most Kiwis they should think about an alternative to the NZ dollar and as a result, Bitcoin adoption is low. Most Kiwis have heard of it, but most still know nothing about it and think of it as a payment platform or tech stock.

How many people in New Zealand have Bitcoin?

Finding out exactly how many Kiwis own Bitcoin is not an exact science, as part of the reason to own Bitcoin is that it’s “off the record”. But there are a few proxies and surveys we can draw some comparison to other countries with.

Statista.com data shows that the number of New Zealanders who “indicated they owned or used crypto” has grown from 6% to 14% from 2019 to 2023. These are very similar numbers to the USA, Australia and the United Kingdom. New Zealand ranked 25th on the list, even pegging with Austria, Poland and Russia. This means over half a million Kiwis use or own “Crypto”, a number you (or politicians seeking office) aren’t likely to ignore.

The highest levels of adoption are unsurprisingly in countries with failing currencies or hyperinflation like Nigeria (47% in 2023), Turkey (47%), Indonesia (29%) and Brazil (28%). The data also shows some interesting outliers such as the UAE, growing from 0 to 31% adoption from 2019 to 2023.

Our friends at Chainalysis rank New Zealand 89th in their 2023 Global Adoption index, taking into account a number of factors such as Retail Adoption, P2P usage and DeFi. The top three countries in the survey are India, Nigeria and Vietnam.

These are only proxies, as they measure “Crypto” ownership and usage, and we all know Bitcoin and Crypto are very different things, but for the purpose of comparing usage and ownership in different countries, they’re useful metrics.

BTC Trading Volumes in NZD

In terms of volumes traded in New Zealand dollars, a paltry volume of under USD $10 million was traded for BTC in 2023, but this figure is misleading as most Kiwis who buy Bitcoin will buy in USD. For reference, the USD trading volume of Bitcoin was USD $1.5 billion.

Source: Statista.com

Bitcoin Merchant Adoption in New Zealand

Again, low. Btcmap.org shows 30 merchants in New Zealand accepting Bitcoin today, and if you’re in the Bitcoin community here you probably know and support many of them personally.

Here's a comparison with cities or countries with similar populations to New Zealand taken from btcmap.org:

Sydney: 23 merchants (NZ wins)

Ireland: 24 merchants (NZ wins)

Finland: 34 merchants (NZ loses)

Costa Rica: 54 merchants (NZ loses)

And how about if we compare with the Bitcoin hotspots we hear about all the time:

Nashville (Pop. 700,000): 7 merchants (pathetic effort, c'mon O'Dell, what are you doing there?)

Austin, Texas (Pop. 1.8 million) 42 merchants

El Salvador (Pop. 6.3 million) 264 merchants

Lugano, Switzerland (Pop. 63,000) 204 merchants

Isle of Man, UK. (Pop. 84,000) 47 merchants

So we’ve got a long way to go, but so has everyone. The interesting takeaway is that Lugano has the most Bitcoin merchants per capita by a long way. Those Swiss were always good with money, looks like they’re getting even better.

But the effort here is strong, there are keen Kiwi Bitcoiners out there paving the streets day and night to help merchants adopt Bitcoin. And here’s their website: https://www.acceptbitcoin.nz/

Kiwi Bitcoin Merchant Shoutout - Connect Chiropractic in Christchurch

Not only does Matt accept and promote Bitcoin at his practice, he puts up Bitcoin billboard ads and presents Bitcoin at the national industry conference. Great stuff Matt!

Which makes Connect Chiropractic our 2023 New Zealand Bitcoin Merchant of the year.

Connect Chiropractic's Bitcoin Billboard in Christchurch.

Need some realignment? Find out more about Christchurch's Bitcoin Chiro here.

Bitcoin Events, Meetups & Spaces in New Zealand

The meetup and event scene is still developing, but the community is growing in both size and strength. The advantage of being in a small country like New Zealand is that there is a "New Zealand Bitcoin Scene", and it's possible to attend events and meet other Bitcoiners all over the country.

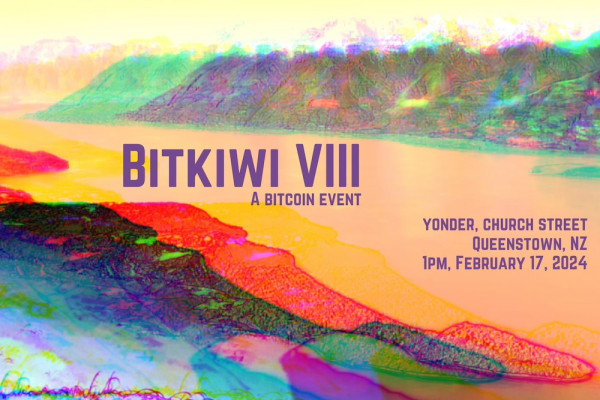

The highlight of the Bitcoin Meetup scene in New Zealand is undoubtedly Bitkiwi, quarterly meetups hosted both at their Wellington home base and around the country.

Bitkiwi - New Zealand's leading Bitcoin Meetup

Started in late 2022 by three schoolmates from Wellington, Bitkiwi events are super laid back, relaxed and friendly. Highlights are the old fashioned “ka-ching” and Pink Floyd’s “money” playing every time you buy a beer with Sats!

See more about Bitkiwi here, and come join the next one!

Bitkiwi VIII in Queenstown.

Bitcoin Meetups in New Zealand

Auckland:

I couldn’t find any info about a Bitcoin Meetup but there must be something, so let me know and I’ll update this page.

Wellington:

Monthly meetups in the Central City, find out more here.

Christchurch:

No regular meetups yet but a solid core community, centered around a few local merchants and businesses.

Queenstown:

Monthly meetups hosted by Rob from Wakatipu Bitcoiners.

Visit Wakatipu Bitcoiners on Facebook.

The Altruist School

This is a free public space for Bitcoiners in the heart of Auckland CBD, open 5 days a week and hosted by a local Bitcoiner, with his own designed hoodies, gear and heaps of Bitcoin books. Hanoz (the founder) runs events and is always happy to sit and talk Bitcoin with newbies or OGs.

Find out more about the Altruist Bitcoin space here.

Inside the Altruist Bitcoin School in Auckland.

Bitcoin Companies in New Zealand

This is an area we seriously have to lift our game. Compared with our Aussie mates across the ditch, there is a deafening silence when it comes to New Zealand companies or initiatives on the global Bitcoin stage. Time to fix that Kiwi Bitcoiners, if not you, then who?

Bitcoin Exchanges in New Zealand

New Zealand does not have its own native Bitcoin only exchange, just a few Crypto exchanges and brokers. The number dropped by one very recently after one New Zealand “Crypto” exchange went bust, surprise, surprise, they didn’t actually have enough funds to actually cover customer deposits.

We have had our own chequered past too, NZ based exchange Cryptopia was hacked and subsequently failed in 2019, one of the worlds largest crypto hacks at the time.

Bitcoin Mining in New Zealand

This is an area that has a lot of potential in New Zealand, especially in the South Island with its abundance of hydro power and low population. But Bitcoin mining is still nascent here for sure.

Our share of the global hashrate comes in at a cool 0.00%, based on the Cambridge Centre for Alternative Finance’s most recent stats (Jan 22), which doesn’t mean there’s zero mining here, just that the hashrate is so negligible it doesn’t even register on the meter. Another source listed New Zealand's total hashrate at 12.55 PH/s.

Listen to an introduction to sustainable Bitcoin mining in New Zealand with Simon Collins from Stackr on the Transformation of Value Podcast.

Stackr Mining

Founder Simon Collins is a leading voice in Bitcoin mining in New Zealand and is out there pitching for investment for Stackr to mine sustainably using hydro power in the South Island.

Visit the Stackr website.

Gridshare

In their own words, “Gridshare builds, owns and operates power responsive data centres, including Bitcoin mining and AI computing”. There’s not a lot of detail on the website about locations, but they have at least one location in Southland close to large hydro generators. We know Bitcoiners who use their services and the sats are real!

Visit the Gridshare website here or read more about their South Island mining operations here.

But not all New Zealand’s hills are paved with digital gold, until recently, a UK based company was mining at one of the large hydro dams in the South Island but went bust. Probably leveraged their ASICS during the bull market and got rekt.

Other Bitcoin Companies in New Zealand

CH4 Capital

More of a Global Company than a Kiwi one, but founder Daniel Batten is a Kiwi and lives here. This is an investment fund with the mission to offset 2% of atmospheric pollutants through mining Bitcoin via vented methane at landfills around the world.

Vist the CH4 Capital website or listen to Daniel’s recent interview on What Bitcoin Did here.

Azte.co in New Zealand

A Christchurch Bitcoiner has set up an Azte.co vendor in New Zealand where you can buy vouchers redeemable for Bitcoin either online or in person. Bitcoiners will know Azte.co, a very low friction way to get Bitcoin. No accounts, No IDs, instant redemption either on chain or via Lightning. The goals are ambitious, to have major New Zealand retailers selling vouchers redeemable for Bitcoin, the same way they do for Apple Music or the Google Play Store.

The Project is still in Beta, but you can register for updates here.

Bitcoin Media in New Zealand

The Transformation of Value Podcast

Hosted by Wellington Bitcoiner Cody Ellignham, this podcast started in 2022 and has been cranking out weekly episodes ever since. The focus is on local initiatives and the contribution Bitcoin can make to a better New Zealand. Lots of thought provoking conversations with a New Zealand angle.

Find out more about the Transformation of Value Podcast here.

KiwiBitcoinGuide.org.nz

Hey, that's us. A community website run by Kiwis with a focus on tools and resources for New Zealand Bitcoiners. There’s plenty of content out there on global macro or Bitcoin technology and tools, but nothing at all for Kiwi Bitcoiners, so this site aims to fix that.

NZ Bitcoiners on Telegram

A useful first contact point for normies to connect with and take their first steps in Bitcoin. There are different groups for different regions and topics, such as Mining, Lightning & Exchanges. A few Bots and scammers around these days too, but still some good signal.

Visit NZ Bitcoiners on Telegram here.

Kiwi Bitcoin Personalities

There are a few Kiwis on the global Bitcoin stage, not quite as many as our Aussie cousins across the ditch though who can lay claim to some leading contributors and organisations, like Stephan Livera, Ketan & Ministry of Nodes, Vijay, Checkmate, Rusty Russell, Amber App, Wallet of Satoshi, Bitcoin Bush Bash, Bitcoin Alive, the Perth Heat and of course Faketoshi himself, Craig Wright.

Tip NZ on stage at Pacific Bitcoin '23.

TipNZ

Tip splits her time between Thailand and NZ, but we do see her smiling face at meetups up and down NZ so we reckon she’s one of us. She describes herself as a Bitcoin rapper, and her Bitcoin themed videos have garnered attention from Bitcoiners all over the world, including Michael Saylor.

Check out Tip’s recent appearance at Pacific Bitcoin.

Daniel Batten

As highlighted above in the Mining section, Daniel lives in New Zealand while operating on the global stage. His voice and message is one which could be very important to help mainstream NZ understand and embrace Bitcoin. Come drop in to a meetup Daniel!

Rigel Walshe

An ex Kiwi cop, now a digital nomad preaching the word of Bitcoin to the masses.

Watch Rigel's talk at the Baltic Honey Badger on Bitcoin as a Religious Phenomenon.

Willy Woo

Not living in NZ now but he did grow up here, Willy has a mixed reputation amongst Bitcoiners as a hokey TA chart snake charmer who pumps shitcoins, but he does talk some sense at some times.

Listen to Willy’s recent interview on What Bitcoin Did here and make your own mind up.

Bitcoin Regulation & Government Initiatives in New Zealand

Like most governments, New Zealand is playing catch up with understanding and regulation of Bitcoin. For the most part, there has been a hands off approach to Bitcoin and “Crypto”, but it is probably because they have no idea yet and have to figure out what the hell it all is first before they come up with some regulations. But don’t worry, they’ve got plenty of wordy papers out there about “the Future of Money” and all that.

Read a wordy paper from the New Zealand Government on the Future of Money.

The Reserve Bank of New Zealand (NZ’s Central Bank) consulted with the public on the Future of Money, which included proposals for regulation on “Private Moneys’ and digital currencies. They received a whopping 50 submissions (out of a population of 5 million) in response and recently published their findings. (See below reference to apathy!)

Many of the findings were quite benign and included recommendations not to stifle development and allow innovation but the guidelines for the consultation (set before the public got their say!) required any regulation to allow for AML / KYC, protect the sovereignty of the NZD as a “Value Anchor” and to retain control of Monetary Policy objectives. So read into that they’re OK with digital money, as long as it’s in a unit which they can inflate or deflate supply of when required.

But it was nice to be asked what we thought anyway.

Parliamentary Inquiry into the current and future nature, impact, and risks of Cryptocurrencies

Yes, this is the title of an inquiry being presented to Parliament later this year. A 112 page report comprising mostly of very middle of the road recommendations in waffly language such as: “encouraging development”, adopting a “technology neutral approach”, establishing a “formal sandbox” and a “cross agency working group”. My favourite is the recommendation to hold “blockchain sprints” to develop new ideas and strategies. That’s a bunch of high powered BS paid for with your tax dollars if I’ve ever seen it.

In fairness, there are some interesting recommendations in the paper, including that educational institutions consider developing courses on Digital Assets and training be made available for Financial and Legal professionals. Another interesting recommendation is to consider the development of a new category of property law for “Data Assets”.

There are a few dead rats in there as well, such as Recommendation #22 to continue with development of a CBDC and New Zealand’s preference for “less energy intensive blockchains”.

It’s hard to know what to make of a report like this, whether there is some genuine good intention to foster innovation or it’s just a bunch of grifters licking their lips at the thought of getting on the Government gravy train. Time and the market will tell.

But what’s more interesting to me is the way this whole inquiry has been run and who is advising on it. Public submissions were held in 2021, but not much publicity was given to these and most Kiwis would have no idea any of this was going on. The 112 page document is to be presented to a panel of 12 Members of Parliament, with the 22 “recommendations” already prepared for them, (don't bother reading that, just sign here). There were a grand total of two independent experts consulted on this, a lawyer and an academic. Wonder how they were selected?

I want to know how just 14 people get to influence the monetary outcomes here for 5+ million, how much do they even know about Digital Assets or how they would even find the time to read this report?

But that’s what you get with Democracy isn’t it! Imagine if there was a neutral money which anyone could opt in to by choice, regardless of what the majority of people who happen to live in the same jurisdiction as you think.

Read or Download the Paper here.

Development of a CBDC in New Zealand

New Zealand is one of many countries developing a Central Bank Digital Currency, and recent consultation with a panel of (two) experts came to the conclusion that they should continue with this development. Public submissions were held on this, the response rate was very low (probably a rugby game on at the time) but overwhelmingly negative.

Read more about the New Zealand CBDC initiative here.

One interesting takeaway from this consultation was that the vast majority of New Zealanders have no idea that their government is planning a radical reform of the entire monetary system. There are ads and billboards everywhere telling people to wear seatbelts, educating the male population on menopause, not to let your mates drive home drunk or to go and register to vote, but none telling people that they’re reviewing everything about how you hold and spend money. No biggie, back to the BBQ people.

Web3NZ

Most Bitcoiners will retch lightly at the site of a name like Web3 NZ, but read on. The New Zealand Government has funded an organization called Web3 NZ which does include members from the Blockchain Shitcoin Crowd as well as Bitcoiners.

Web3 NZ is led by a Bitcoiner, who we’ve met at events and he is a Bitcoiner, runs a node and seems legit, so that’s a good start. Our Taxpayer $$ even paid for him to fly to Bitcoin 2023 in Miami this year (and a shitcoin conference too), but he is on the record saying there was a lot more development and energy at the Bitcoin conference.

I met one of the Web3 NZ team at an event earlier this year and she openly admitted she didn’t know a lot about Bitcoin but wanted to learn. So I started off with my best intro spiel and she really surprised me by recording me, then publishing the bulk of what I said into a post the next week.

If that’s the attitude and openness that a govt funded agency has towards Bitcoin, they’re welcome at meetups and in the community anytime. Until they start pumping NFTs and Proof of Stake, then they're out the door!

A quick perusal of the Web3 NZ website shows a video called “Balancing New Zealand’s Energy Asymmetry using Carbon Negative Bitcoin Solutions”, right on the front page. they also recently organized a Lightning Tutorial with Lisa from Base 58 and made it freely available to everyone, including a class of University students in Auckland. So positive signs for now.

Tax on Bitcoin in New Zealand

The laws around tax on Digital Assets were recently rewritten, and the Inland Revenue and Parliamentary Reports acknowledge that this new class of asset challenges current tax law. Bitcoin is treated like a form of property for taxation purposes in New Zealand, so it is subject to tax on any capital gains realized at the time of sale.

If you receive your income in Bitcoin, you have to declare it and include GST (Sales Tax) where relevant. Basically income in Bitcoin is treated the same way that income in a foreign currency would be, which is actually a really good way to frame it.

There is nothing groundbreaking or radically different about New Zealand's approach to tax on Bitcoin, although most people in New Zealand are very suspicious of wealthy people so if it goes to $1,000,000 a coin expect the taxman to come knocking for a good chunk of your gains.

Read the guidance on Taxation on Crypto Assets from the Inland Revenue here.

Bitcoin in New Zealand Politics

Unfortunately, a big fat donut here. Even though Bitcoin is in the conversation at the highest level of politics in other countries, even with an election this year we’re not aware of a single politician with a Bitcoin Policy or talking about sound money.

A few have talked about the problems, but no-one is out there proposing Bitcoin as a solution. So a long way to go here.

Other Bitcoin Initiatives in New Zealand

Accept Bitcoin NZ is ready to help Kiwi merchants.

AcceptBitcoin.nz

Another community initiative aimed at helping merchants in New Zealand accept Bitcoin. With the scene still nascent and Kiwis being the friendly folks we are, we even do house calls!

Find out more about AcceptBitcoin.nz here.

Orange Pill the New Zealand Parliament

With an election approaching in New Zealand this year, here’s an initiative led by Simon Collins of Stackr Mining to give every newly elected member of Parliament a copy of the Bitcoin Standard.

Support the Orange Pilling of NZ Parliament on Geyser here.

Orange

Run by prominent Kiwi Bitcoiner James Viggiano, Orange is a hosted server in the popular survival game Rust with the aim of educating players in the game about Bitcoin and working with others. Learn, survive and thrive with Bitcoin.

Find out more on the Orange website here.

Bitcoin at Auckland University of Technology

Jeff Nijsse as a Senior Lecturer of Engineering, Computer and Mathematical Sciences at the Auckland University of Technology and is teaching Bitcoin to Computer Science students there. This is one of the leading Universities in New Zealand in the heart of Auckland CBD.

Listen to Jeff explain more about his teachings on this interview here.

The open source Bolt Card project

Some of the developers in the Kiwi Bitcoiner community have worked hard to build open source services and apps enabling any Bitcoiner to program and use Bitcoin's Bolt Cards in a self soverign way. To have a go at this yourself download and install the Bolt Card Wallet

Visa and Mastercard should be quaking in their boots as not only can you program and configure your own cards, you can also allow members of your community to connect to your Bolt Card Hub and they can then use your service to program their own cards. Bitcoin Bolt Cards can come with custom designs made by the biggest artists in the space and are wayyyyyy cooler than the regular old payment cards as some Bolt Cards can also come with laser eyes that light up when you pay.

Opportunities & Headwinds for Bitcoin in New Zealand

Historically New Zealand was an innovative country with a history of pragmatic problem solving, we have good digital infrastructure and a relatively digitally savvy population. New Zealand has all the building blocks to be a leader amongst Bitcoin adoption in developed nations.

The problems Bitcoin can solve are very evident here too. In the last two decades, housing has become unaffordable for many Kiwis, even double income households. More recently, it’s food which is becoming expensive too, everyone sees that at the supermarket.

We were one of the first nations in the world to adopt a nationwide Electronic Payments Network (EFTPOS) and in years gone by have shown courage and innovation to forge our own path.

But in recent years it seems like we’re bogged down by regulation and political correctness, it's very difficult for any major initiatives to get done here now and there seems to be less and less merit based outcomes in society.

Another gap which is very evident is the lack of New Zealand companies or initiatives on the global Bitcoin stage. As a borderless, global network, there’s no reason New Zealand entrepreneurs and developers can’t be on the frontline building the internet of money. The silence in this space is deafening and we need to fix that.

But the biggest headwind to widespread adoption in New Zealand is apathy. Until recently, life has been pretty good in New Zealand for most people, so they just don’t see the need for something that would induce a major paradigm shift as Bitcoin would and ask them to question and challenge everything they know.

But anyway, the Rugby’s on, so I’m just gonna go watch that while you try to fix the broken financial system. But let me know how you get on, I’d love to help if I can. Yeah, yeah, na.