How to buy non-KYC Bitcoin from New Zealand?

If you’ve been in Bitcoin for a while you have probably heard people talking about “KYC” and “non-KYC” Bitcoin. What is this and if you want KYC free Bitcoin, how do you get it? This blogpost is a guide for Kiwi Bitcoiners on the best way to buy Bitcoin privately, that is without handing over your personal details and ID, putting you at risk of a hack, leak or surveillance.

Article Contents and Quick Links

Key Takeaways

- There are viable options for Kiwis to buy Bitcoin "KYC-free", this means buying anonymously without handing over your identity and credentials.

- On the open global Bitcoin network, Kiwis have unrestricted access to all the peer to peer platforms. Each of these platforms have different trade offs and methodologies, the best way to learn these is to experiment for yourself.

- The main challenges Kiwis face is finding liquidity in NZD and finding buyers who accept the payment methods we have access to. But buying in USD through services such as Wise & Revolut are excellent workarounds.

- For us there was one clear winner as the best way for Kiwis to buy KYC free Bitcoin: Robosats. No account setup or login required, easy to use, no technical barriers, multiple payment options and fast settlement on Lightning, it gets our vote.

What is non-KYC Bitcoin and why should I want to buy it?

Most people start their Bitcoin journey buying from an exchange like Bitaroo or a broker like Easy Crypto. You sign up, provide all your personal information including your name, date of birth, driver license, IRD number, and passport, and only then are you ready to go. And that’s all well and good, until you go a little further down the Rabbit Hole and start hearing people talking about “KYC” and all the evil associated with that.

KYC stands for “Know Your Customer” and is supposedly about “safety” but really it is about having as much information about you and your payment habits as possible.

If you’re this far into Bitcoin now, you are probably pro-privacy and pro-personal freedom, kind of along the lines of “I can spend my money on whatever I like and no-one needs to know about it”. Bitcoin is not illegal in New Zealand, we have personal privacy guaranteed to us in the Bill of Rights, so why do I have to give up all this personal information to buy it?

The primary motivation for buying Bitcoin non-KYC is to protect your online privacy. Once you give up your personal details to an exchange or platform, this becomes a target for hackers or a risk for leaks. Even large companies with experience and budgets for data protection have experienced leaks or hacks, the only way to protect your privacy is to not hand over your information in the first place.

I’ll leave it to you to work out the ethics and morals of which of these practices is the illicit activity and whether you are doing the right thing or not by buying non-KYC Bitcoin. This guide aims to introduce and evaluate the most accessible options for Kiwis to buy “ethical” Bitcoin.

What this guide does not intend to do is provide a step by step guide through each method, there are some excellent guides online which we’ll link to so there’s no need to reinvent the wheel. Instead we will focus on the bit that is NZ-centric, namely how you get your crappy old NZD (fiat) into the hands of someone selling Bitcoin on the other side of the world.

How to buy Bitcoin while maintaining my privacy?

How does buying KYC free Bitcoin work?

All the methods we describe work on the same premise:

- You find someone who wants to sell Bitcoin. This could be through word of mouth or an online platform.

- You agree on a price. These platforms are all marketplaces, where buyers and sellers interact with each other to determine the price of Bitcoin for each transaction. There is no "fixed price" on any of these platforms.

- You pay them fiat currency. If you’re meeting your seller face to face, this involves you handing your fiat to them directly. If you’re not meeting face to face, this involves you transferring the money to the buyer via a money transfer app or service.

- After receiving your fiat, the Seller sends you your Bitcoin. This could be onchain or via Lightning.

But hang on, I hear you say. If I’m sending money to the seller via Money Transfer services like Wise or Revolut, they have my ID so it’s not KYC free then is it?

Yes, your Money Transfer service or bank will have your details. But all they can see is that you sent some money to someone else, somewhere in the world. This transaction is not tied in any way to the Bitcoin, unless you’re stupid enough to write something like “Bitcoin Purchase” in the reference field!

Just like buying something from someone on TradeMe, you’re paying for a good or service that is 100% legal in New Zealand so exercise your right to Privacy and keep a few details to yourself on this one.

What are my options for buying KYC free Bitcoin from New Zealand?

Here’s a quick summary of the services we tried for this article, click on the links to jump down to the details.

Buying KYC Free Bitcoin in New Zealand - TLDR:

The biggest challenge for Kiwis buying non-KYC Bitcoin is usually the payment method. There’s practically zero NZD liquidity on these platforms so you have to buy in USD, Euro or another currency. Many USD sellers accept Strike, CashApp or Venmo, which we don’t have access to.

The best payment method we found to buy Bitcoin KYC free with was Wise. Setting up a Wise account is easy, and though it still requires some ID, it means you are not associating your everyday New Zealand bank account with P2P trades, and there is nothing that actually links it to buying Bitcoin. All that anyone snooping on your account can see is that you have paid some people overseas, no one can prove what the payments were for. Once you have a Wise account you can easily top it up and then transfer to sellers in the required currency in real time and with nothing more than their email address. The foreign exchange fees that Wise charges are some of the lowest available. We tested Wise on all the above platforms and it worked every time without a problem.

A new option in the NZ market is Revolut, which seems popular in Europe. We’ve just downloaded the App and will include it in our experiments.

Comparing the best ways to buy non-KYC Bitcoin for Kiwis

|

Privacy |

Simplicity |

Fees |

Technical |

Liquidity |

Payment Methods |

|

|

In Person |

5/5 |

5/5 |

None |

0/5 |

2/5 |

Cash |

|

Azte.co |

5/5 (in person) |

4/5 |

3/5 |

1/5 |

3/5 |

Whatever your vendor accepts. |

|

HodlHodl |

4/5 |

4/5 |

2/5 |

2/5 |

3/5 |

Multiple. Wise, Revolut, Paypal etc. |

|

Robosats |

5/5 |

4/5 |

4/5 |

3/5 |

3/5 |

Multiple: Wise, bank deposit, Venmo, etc. |

|

Bisq |

5/5 |

1/5 |

2/5 |

4/5 |

3/5 |

Multiple, as above. |

KBG Tip - Don’t write off buying Bitcoin Person to Person

Don’t underestimate the power of in person transactions. If you can find someone in real life who wants to sell you Bitcoin in person, this can actually be your most private option.

We’ve found Bitcoiners visiting from overseas may want to sell some BTC for NZD to use while here, it’s a great win-win, you get some KYC free sats and they get some NZD cash without all the hassle.

The first time I had the opportunity to buy Bitcoin IRL from another Bitcoiner I was a bit surprised, “What do you mean you’re selling Bitcoin? Aren’t we supposed to Hodl to the death?” But then it happened again, and again.

Bitcoin is money and sometimes people need to exchange money for physical goods and services, so if you can help a Bitcoiner turn their sats into Fiat for something they need, it’s a win-win, so give it a go.

Buying Bitcoin in Person

What?! I hear you say. We’re digital natives, you’re not seriously expecting me to actually meet another person in real life to get some Magic Internet Money, you can’t be serious. Yes, this still happens and it is how members of your species have been exchanging goods and services since the dawn of time. Don’t write it off.

Find another human being who wants to sell you Bitcoin for dirty Fiat, agree on a price and make your exchange. It’s not that hard.

Once you’re involved in your local Bitcoin community, someone may ask you, or you may hear of someone who wants to sell Bitcoin. When it first happens you are kind of taken aback, hold on there soldier, I thought we were all Hodling to the death here?

Then you realize that there are some people who have been in Bitcoin for long enough to see a real appreciation in their coins and they actually use them to buy real world goods or services. Get used to it, and even better, take advantage of it.

Like everything in the world of Bitcoin, you are free to make your own choices and take responsibility for your own actions, so you need to figure out how to buy Bitcoin from a real person.

Overseas Bitcoiners visiting New Zealand can be a great source of KYC-free sats, if they’ve got Bitcoin and they’re traveling they probably want some NZD to use on their trip and you could well be in the market for some non KYC sats, a match made in heaven!

It’s a lot of fun to connect with Bitcoiners on Twitter or the Orange Pill App, show them the sites (including your local BTC friendly merchants), trade some sats for NZD and make friends in the process. If you're in one of our international gateway cities, like Auckland or Christchurch, you are in a perfect spot for this, as most international visitors will travel through either on their way into or out of the country which gives you the perfect opportunity to meet fellow Bitcoiners and show them some good old Kiwi hospitality. (and score some KYC free sats!)

In these kinds of exchanges, the easiest and most trustless way is probably to meet up in person, hand over the NZD and receive the Bitcoin exchange to a mobile wallet then and there. This has the added bonus of extra privacy for the buyer as there’s no legacy banking transaction involved at all.

Agree on a rate for the NZD / BTC exchange by using any of the major exchanges (Coinmarketcap, Easy Crypto or Dassetx are all options) as a starting point and negotiate from there. This is the beauty of a peer to peer exchange in a free market, no-one other than the two participants in the transaction determine the price.

Advantages of Buying Bitcoin in Person

- Protect your online privacy, no digital footprint

- Meet other Bitcoiners

- No transaction fees

Disadvantages of Buying Bitcoin in Person

- Irregular, you don’t know when opportunities to buy will come up.

- Requires meeting physically and carrying cash, some people won’t like this.

- No predetermined market price, you have to work it out for yourselves.

How to buy KYC free Bitcoin - Azte.co

Azte.co offers a unique solution to the AML/KYC (anti money laundering / know your customer) requirements around selling a Digital Asset like Bitcoin, they don’t sell Bitcoin, instead they sell you a voucher which you can redeem for Bitcoin. Very clever.

There are Azte.co vendors all around the world, and you buy the voucher for the amount of sats you want and pay them in dirty fiat. They send (or give) you the voucher, which includes a QR code to redeem your sats, either on-chain or Lightning.

This is a clever approach to financial regulations in most countries, which treat Gift Vouchers differently than other financial products. As long as it works, who cares, right?

If there’s an Azte.co vendor with a physical location where you live, you can make the exchange in person and eliminate the need for a bank transaction which makes it very private. If you can’t meet your vendor face to face, then you’ll have to transfer the money to receive the voucher. This involves an element of trust, as you will have to send the fiat to the vendor before you receive your sats. You can also order your voucher over the telephone too! Azte.co vouchers are now available in Brazil to more than 125,000 retailers and is seen as an easy way to access Bitcoin for any amount.

Fees buying Bitcoin on Azte.co

Azte.co charge a 5% fee, which is usually broken down into a 3:2 split between the Vendor and Azte.co. Considering KYC free Bitcoin usually comes at a small premium, 5% is not too bad.

Advantages of buying Bitcoin via Azte.co

- If your vendor has good liquidity, you can buy on demand

- No transaction records if you buy face to face, protect your privacy fully

- Quick and easy, no account creation or waiting for offers to be accepted

- A great way to gift Bitcoin

Disadvantages of buying Bitcoin via Azte.co

- Involves trusting your vendor with your funds if you’re paying online

- You rely on your vendor having liquidity when you want to buy

- If you pay via bank transfer, your vendor does have your bank details so it's questionable whether it's truly "KYC free"

Is there an Azte.co vendor in New Zealand?

Good news, yes there is. A Kiwi Bitcoiner has just started New Zealand’s first Azte.co vendor and is operating out of Christchurch. He offers in person purchases from a pop up store and delivery options. Long term the goal is to partner with major retailers to include Azte.co in the Gift Vouchers available in store. We made several test buys with the new NZ vendor for this article and can report that it worked a charm, we sent NZD and got our voucher for sats via Lightning right away. He’s even offering a discount on fees for a while so hit him up on Twitter or Telegram at @jamesscaur.

Find out more about Azte.co

Visit the Azte.co website

Read the FAQ section on Azte.co

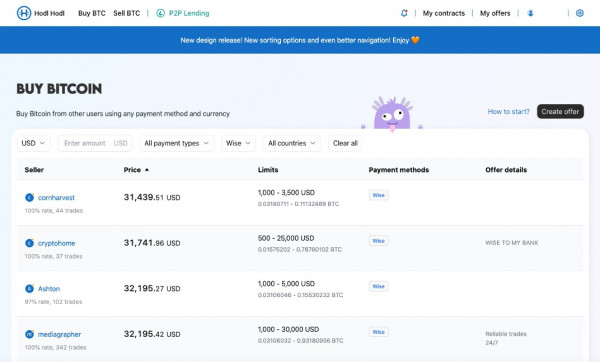

How to buy KYC free Bitcoin - Hodl Hodl

Hodl Hodl makes it pretty easy to buy KYC free Bitcoin from anywhere in the world, all you need is an email address. No ID or selfie with your thumb up your arse required.

Hodl Hodl have found an elegant way to circumvent regulations by never actually holding any money, Hodl Hodl work as an intermediary, putting buyers and sellers together but never receiving any money

For a full walkthrough of Hodl Hodl we recommend the BTC Sessions Video.

Here’s a quick summary of how to buy KYC free Bitcoin on Hodl Hodl for Kiwis.

- Create an account at HodlHodl.com with just an email address

- Enter the marketplace, looking for the currency, minimum amount and payment type that matches. NZD is listed as an option, but we have never seen any offers. It could happen in the future, but right now there’s next to zero liquidity in NZD. Your best option is USD or EUR, they always seem to have the most offers, but even in these currencies there can be a very low number of offers in the market.

You also have to choose an offer that accepts a payment type you have. This also excludes us Kiwis from the major US options such as Strike, Venmo or CashApp. Wise and Revolut are popular and all the test buys we did were using Wise which worked fine. There are some interesting options like paying with an Amazon Gift Card as a payment method too, which is interesting but at the time of our tests we couldn’t find an offer that would accept this payment type. - Accept an offer. Once you do this the seller is required to transfer the Bitcoin to an on chain multi-sig address controlled by him/her and Hodl Hodl. This makes it fully visible to you, you can check the Bitcoin has been transferred on-chain before you make your payment. This is only possible on an open permission-less ledger like Bitcoin.

- Send your payment to the Seller using the agreed upon method. HodlHodl has a message interface which you use to communicate with the seller and you can see which stage of the process you’re at. One potential disadvantage of HH is that as these are on-chain transactions you have to wait until it’s confirmed in a block and if fees are high then this can take a while. One of our test buys was during a time of high fees and it took 1.5 hours for our transaction to get into a block. I can see this as an issue HH will want to address as it may mean their business model is not feasible in a prolonged high fee environment. Maybe they’ll add Lightning.

- Once your Seller confirms receipt of your fiat, your BTC is released to your address. Using Wise payments took literally seconds to be confirmed, so it was quick and easy.

Overall, we found Hodl Hold really easy to use and the purchases we made were all completed successfully.

Buying Bitcoin in USD on Hodl Hodl

If there is one potential disadvantage of buying through Hodl Hodl it would be that because all transactions are on chain, you are at the mercy of fees and blocktimes. You have to wait for the escrow transaction to be confirmed in a block before you can complete your transaction and this can take time.

Hodl Hodl’s model is to calculate the fee at a rate which should get the transaction confirmed quickly, but this is not an exact science. For one purchase we had to wait 90 minutes for our escrow transaction to confirm and I was getting pretty close to having to abandon the whole thing because it was bedtime. Hodl Hold must be aware of this as a threat to their business model, and I did hear mention of them looking at Lightning as a payment model, which would make sense and resolve this issue.

Hodl Hodl lists the NZD as a supported currency, but we never saw any significant liquidity there so if you’re buying from NZ you will have to use a service like Wise to convert to USD and buy in the USD market. Not an insurmountable obstacle and something Kiwi Bitcoiners are used to by now, maybe one day soon we’ll see some liquidity on these platforms in NZD. We would hardly know what to do!

Fees for buying Bitcoin on Hodl Hodl

Especially as buying from NZ involves transferring to USD which incurs additional costs, the fees associated with buying from Hodl Hodl were a little higher than we anticipated. One purchase we made was USD100, and by the time HH and Bitcoin transaction fees were paid, we were left with USD86 worth of Bitcoin, and that is not taking into account the FX fees involved getting the NZD into USD.

Here’s an example of the fees on Hodl Hodl, from a test buys for USD100:

- Trading fee of 887 sats (USD$ 0.30)

- Bitcoin network fee 4021 sats (USD$1.36)

- There’s also a partner fee, if you’re using Hodl Hodl through a connected platform like Trezor Suite.

- Plus whatever FX fees to get your NZD into USD and transfer to the seller.

But everything comes at a price and we leave it to you, sovereign individual, to determine if the costs of buying KYC fee sats from Hodl Hodl are worth it. We would definitely buy again from Hodl Hodl.

Advantages of buying Bitcoin on Hodl Hodl

- No ID required, only an email address needed.

- Access to multiple markets, USD, EUR, etc.

- Full visibility of your Bitcoin on-chain until you receive it.

Disadvantages of buying Bitcoin on HodlHodl

- When on-chain fees are high, transaction fees will also be high.

- Higher fees in general than the other methods we tested.

- It is run by a centralized company so could be subject to closure by authorities.

Find out more about Hodl Hodl

Visit the HodlHodl website

Watch the BTC Sessions Hodl Hodl video

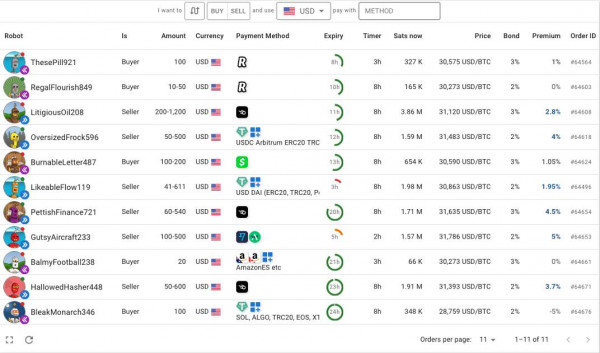

How to buy KYC free Bitcoin - Robosats

As we progressed through the various options to buy KYC free Bitcoin we found ourselves getting deeper and deeper into the rabbit hole of decentralized freedom tech. Robosats is a very interesting platform, and if this was the first Bitcoin platform you ever encountered as a newbie to the space, it would be mind bender for sure.

So what is Robosats? Robosats is similar to Hodl Hodl in the sense that it’s an online marketplace putting buyers and sellers of Bitcoin together, but the tools and methodology used are very different. Even describing it pushes traditional vocab to the limits so the best way is to walk through the steps you take to buy KYC free Bitcoin on Robosats.

- Visit the Robosats website using their .onion address on the Tor browser.

- Create a one time “Robot” avatar for your trade. You will receive a key you can save to recreate the identity in the future, but it’s recommended to use a new identity for each trade. Your identity will receive a name like “GutsyAircraft102” or “Occupied Blood233” and a Robot avatar.

- Open up Market Place and review offers or post your own bid. Select your preferred options for fiat currency and payment method, this will filter the offers to match your criteria. NZD is an option here, but we never saw any offers.

- Before you can accept an offer you have to post a small amount of Bitcoin as a security bond. You’ll need a Lightning wallet with some sats in it to do this (E.g. Custodial options: Wallet of Satoshi, non-custodial options: Breez or Phoenix).

- Once you accept an offer (or have your bid accepted) you go through a similar process to Hodl Hodl, the buyer and seller are put together to proceed through each step of the process to where you send fiat to the seller using the agreed upon payment method.

- Once the seller receives your funds, your Bitcoin will be sent to you on the Lightning Network, so you need to have a Lightning wallet set up and ready to receive.

The best way to really understand Robosats is to try it for yourself, the second best way is to watch the BTC Sessions video on Robosats.

Buying Bitcoin in USD on Robosats

Robosats definitely felt more advanced and “out there” than the previous two methods. The one-time identities and robot avatars are cool, but how their security method works was a bit perplexing. You are required to post a bond in sats before the trade, but the amount you post is minimal, say just a couple of dollars to make a USD100 trade. The seller is required to lock up the entire amount in a Lightning Invoice before they can participate in the trade, and there’s a dispute process you can enter into if needed.

In terms of buying on Robosats from New Zealand, the NZD is listed as a currency supported but we never saw any liquidity there at any time during our tests. So that means you need to convert to USD or EUR and buy in those markets. Payment methods were similar to those on Hodl Hodl, with Wise and Revolut seeming to have the best liquidity of the payment methods available in New Zealand.

Fees for buying Bitcoin on Robosats

The fees on Robosats were more reasonable than the other platforms we tried, here’s what you’ll pay:

- FX fees to convert your NZD to USD using a service like Wise

- Transfer fees on Wise

- Robosats trade fee (eg. 0.175%)

- Lightning Network fee to receive to your wallet

- Any fees your wallet may charge to receive

Advantages of buying Bitcoin on Robosats

- Privacy. With no user accounts and access via the Tor network, your privacy is protected more here than the other methods we tested.

- Easy access. No logins required, just go to the Robosats website via their .onion address and you can make your first buy.

- Lightning withdrawals. Cheaper fees and the ability to consolidate your sats before moving to Cold Storage.

Disadvantages of buying Bitcoin on Robosats

- You need to have some Bitcoin on a Lightning wallet to buy on Robosats.

- Liquidity that matches your payment type and preferred currency can be low or limited.

Learn more about buying KYC free Bitcoin on Robosats

Visit the Robosats Github page

This is a link to the Robosats Github page where you can find the .onion address. For privacy, do not connect to Robosats via clearnet, use Tor.

Watch the BTC Session video on Robosats

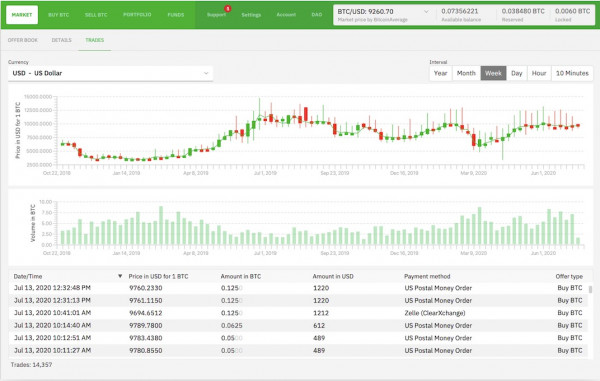

How to buy KYC free Bitcoin - Bisq

The name Bisq comes from the old “Bitcoin Square”, a peer to peer marketplace from the early Bitcoin days, and it is an accurate representation of what Bisq does in the digital space. Another step down the decentralized FOSS rabbit hole, Bisq is an Open Source application you download to your own computer (after verifying the source code and signatures first of course) and run locally, which connects you to their global marketplace of Bitcoin buyers and sellers.

When you take a step back and think about how Bisq and other decentralized applications work, you really appreciate how much of a paradigm shift this all is. This is a network of people around the world downloading and running Open Source software to connect and exchange value, without performing any identity checks or vetting. You also appreciate how hard it is for some people to understand and even better, how hard it is going to be for anyone to try and stop it.

Bisq is nothing more than software which you’ve downloaded from the internet, there’s no company or organization running this, just open source developers working on code. You download the code and run the application, which happens to create a marketplace of buyers and sellers of Bitcoin. If you find a seller with whom you agree to a transaction with, you arrange a transaction of fiat currency between the two of you to settle the deal. This happens outside of Bisq, with no link to the interaction on Bisq visible anywhere.

Buying Bitcoin on Bisq

Bisq is the most technical of all the peer to peer options we tried, downloading and getting the application to work was quite simple, but we got lost when we tried to connect it to a node. There were instructions to update the bitcoin.conf file, which felt a bit too serious to me so I stopped there. I could see the buy and sell offers on the application, and the purchase process looked similar to Hodl Hodl or Robosats in the steps involved and payment methods.

But we didn’t actually complete a test transaction, as I didn’t want to do it connecting to an unknown node. Bisq supports the same payment methods and currencies as the other methods we tested and steps in as an arbitrator if there’s a dispute.

One interesting element of Bisq is that there is a token (BSQ), which to many in the Bitcoin world is a huge red flag and the sign of a project to be avoided. The token can be used to pay transaction fees, and offers discounted fees for anyone who uses it. But it is a crypto currency (a shitcoin!) and is tradable on exchanges, so some would say this clouds the incentives of the project developers. But seriously, what could go wrong with a token issued by an online exchange platform used to pay trading fees? (Anyone remember FTT token?)

Fees for buying Bitcoin on Bisq

The fees on Robosats were moderate, similar to those on Hodl Hodl, more than Robosats. You can reduce your trading fee by paying in the BSQ token.

- 0.7% fee to take an offer

- Bitcoin network fees (mining fees)

- FX and transfer fees on your chosen payment method

So although we didn’t actually test Bisq with a purchase, here’s our summary:

Advantages of buying Bitcoin on Bisq

- Fully decentralized platform with no central point of failure.

- No ID or even an email address required.

Disadvantages of buying Bitcoin on Bisq

- Technically advanced option, not for beginners or non-technical people.

- It has a token, which to some Bitcoiners makes them “Shitcoiners”.

Find out more about Bisq

Watch the BTC Sessions VIdeo on Bisq

How to buy KYC free Bitcoin from New Zealand - A Summary

The great thing about Bitcoin is that it is one global, permissionless market which Kiwis can participate in just as easily as anyone else in the world with access to the internet. That means when a new Peer-to-Peer platform is released onto the Marketplace, Kiwis can get on board right away.

But where it gets a little trickier for us is with currency and payment methods. Most of these platforms will accept offers in any currency or payment method, it’s just about critical mass. As the saying goes, Liquidity begets Liquidity, the biggest pools of liquidity will continue to grow. And in terms of currencies, that means the USD is still king, and that’s not too hard for Kiwis to deal with if you have access to a service like Wise.

The same issue exists around payment methods, most sellers of Bitcoin are in the US or Europe and they use payment platforms like Strike, Cash App or Venmo, which we can’t access here in NZ.

But luckily enough there are services available here like Wise and Revolut which make it easy to keep a USD or EUR balance and transfer fiat to sellers of KYC free sats on these platforms.

So if you’re a Kiwi Bitcoiner and keen to experiment with KYC-free sats, give the above options a try and let us know what you think.