Bitcoin has failed in its central task - a response

In January 2025 Bitcoin is making world headlines, including here in New Zealand with Stuff columnist Damien Grant writing a piece called "Bitcoin has failed in its central task - to become money". The article was shared on X, which drew the predictable responses, and as we know Bitcoin is a topic which requires some time and effort to understand, instead of throwing up a quick response on X, we wanted to respond to Damien's work and invite him to learn more about Bitcoin from the NZ community.

Bitcoin is a new paradigm and while it's tempting to jump to hasty conclusions based on clickbait headlines, some work spent to understand what Bitcoin is (and what it's not) uncovers some unexpected gems.

So here we go, a Bitcoiner's response to Damien Grant's article.

"Bitcoin has failed in its central task - to become money"

The stated objective of Bitcoin, as outlined in the 2008 whitepaper is to create a "Peer to Peer Electronic Cash System", meaning that two people can transact directly with each other online, without going through a middleman or third party.

There's more detail on this objective in the whitepaper, but in regard to the claim that Bitcoin has failed at becoming money, we note the following:

- In 2024 the Bitcoin network settled over USD $19 trillion in value, more than the Visa network.

- Bitcoin is now the world's fifth largest base money, behind only the fiat currencies of the USD, Chinese yuan, Euro and Japanese yen and Gold.

- Bitcoin is the world's seventh largest asset, in 2024 it eclipsed Silver and Saudi Aramco in market cap. This means that it is the seventh most popular choice for people to store their wealth, behind Gold, Apple, Nvidia, Microsoft, Alphabet (Google) and Amazon.

If Bitcoin is not money, then with $19 trillion settlement value and more market cap than all but 4 of the world's fiat currencies and the seventh largest asset on the planet, what is it?

But we think Damien is referring to the means of exchange function of money in the article, which we'll go into below.

Damien starts the article by painting a picture of the excess and culture of the 1980s in New Zealand, drawing our attention to the "Aeroplane Game", which sounds like a small scale ponzi scheme, where new participants to the game provide profits to the organizers. The classic multi layered marketing scheme, to which Damien draws the similarity to Bitcoin.

"Yet you need to go back to the tulip era to rival the collective insanity that is driving the greatest financial absurdity of the modern era; Bitcoin."

Other than saying that Bitcoin only has value because new people are enticed to join, there's no further detail or cited sources of this "collective insanity" to support this conclusion. As Damien said in the article, this is his opinion and he acknowledged he has been wrong about Bitcoin in the past some data or sources would give this claim more credibilty. Bitcoin has been adopted by nation states and corporations and is past the point of being dismissed as a collective insanity. You need to do better than that Damien.

From this point the article goes into specific comments about Bitcoin, to which we'll provide some commentary, clarifications and questions.

The first thing to understand about Bitcoin is that it's not a company, nor an organization nor a product. It's an open source protocol and network. What does that mean? From a physical commodity point of view, it's like Gold, which is a product of the earth's crust and there's no CEO of Gold or a gold board deciding how much to produce or how much exists. Just individuals around the world who put value in gold, and decide to buy, sell or hold it at certain times. Think of Bitcoin as digital gold.

If you're technically minded, another analogy is a protocol like TCP/IP, the base layer protocol which the internet operates on. There's no CEO of the internet, no one is controlling TCP/IP, but lots of companies and people operating on it. Think of Bitcoin as the internet of value, it's a base layer protocol which people can use to exchange value using a digitally native currency.

So unfortunately Damien, there's no one organizing parties or sales events for new entrants to Bitcoin like they did with the Aeroplane Game in the 80s, Bitcoin is an open global protocol for anyone to use at any time if they wish.

Damien then reminds us that he has (like many others) predicted Bitcoin's failure before, in 2018:

"Now. I should disclose I have predicted Bitcoin would fail before."

"Back in 2018, when it was $14k, as opposed to the $100k it is today. It takes a certain type of idiot to be proven wrong so demonstratively and yet persist, but, yes. I am that idiot."

The link provided is an NBR article behind a paywall, so I wasn't able to read it but the first few lines visible convey the idea : "It isn't going to work and not just because something as volatile as the moral compass of Oprah Winfrey is never going to function as a unit of value or medium of exchange." This actually got me interested to read more, because I've heard a lot of analogies about Bitcoin over the years but likening its volatility to Oprah Winfrey's moral compass is something I haven't heard before.

But alas, the walled garden of a pay wall kept this treasure from my grasp. (Heard of open source content Damien, it's very libertarian, you might like it!)

And the obvious point here (as Damien pointed out in the following paragraph) is that Bitcoin hasn't failed, in fact since 2018 it has grown from a market cap of USD$65 billion to over $2 trillion in early 2025. This is an increase of approximately 3000%, but surely if it is "not going to work" there would be some cracks visible over a seven year stretch? If it is indeed a "collective insanity" then why is it still here and stronger than ever?

The story of Bitcoin's success is a lot more than market cap, in the seven years since 2018 millions of people around the world have started using Bitcoin as money as they realize the failings of fiat currency and are voting with their feet.

Damien acknowledged that he was wrong about Bitcoin's failure, but curiously in the last paragraph of the article admits he may have to write this article again in seven years if Bitcoin is still going. The question we would ask Damien is, at what market cap would you acknowledge that you could be wrong about this and it's worth trying to understand more about it to work out why it's still here and still growing? $5 trillion? $10 trillion? $20 trillion?

You don't have to become the Peter Schiff of NZ Damien

"At the time I speculated Bitcoin was limited because it was being run by a decentralised collective and would, in time, be superseded by a product created by a private actor with the discipline and expertise we expect from modern corporations."

This is an interesting take from a self described "libertarian" as Bitcoin is a product of a free market driven purely by market incentives and voluntary participantion. Bitcoin's strength is its decentralization, the very fact that it wasn't created by a private actor such as a modern corporation has meant it has been able to grow and succeed to this point.

But the point we think he's making is that private actors could provide a better solution than governments in this area. On that point we agree.

But we certainly challenge this statement "with the discipline and expertise we expect from modern corporations"

You mean like these modern corporations?

Kiwibank charged after overcharging customers

Westpac admits to misleading customers - FMA action

ANZ this time, FMA action against ANZ for misleading customers

Damien is right when he describes Bitcoin as being "decentralized", but this is what makes it strong, resilient and able to repel both internal and external attacks. One of the world's largest companies, Facebook, attempted to launch a private currency in 2020, this probably fits the bill of what Damien describes as "a product created by a private actor". The project was squashed quickly by the US congress as they didn't want it to become a competitor to the US dollar. Bitcoin is also a competitor to the US dollar, but because it's decentralized, there is no one central person or organization to be pressured so it keeps growing.

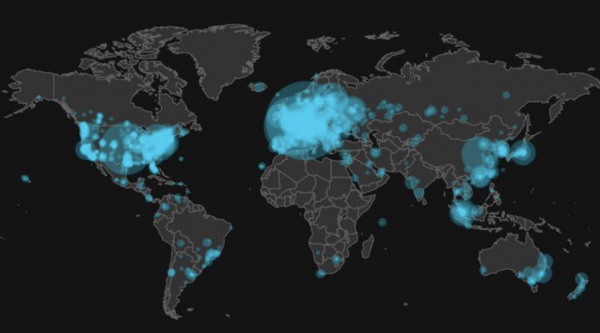

Bitcoin is now the world's largest computer network, a network orders of magnitude larger than the combined size of the clouds that Amazon, Google, and Microsoft have built over the last 15-20 years. This is represented by a distributed network of computers providing 780 exahashes/second (the computational power required to create blocks and secure transactions), 65,000 network nodes relaying blocks and transactions for millions of users worldwide. Remember all this has been achieved purely on market incentives without a central company, organization or government behind it. Bitcoin is a planet sized network and it's not going anywhere.

Nodes around the world on the Bitcoin network

The Bitcoin network has been running since 2009 with 99.98% uptime. Bitcoin now represents over USD$2 trillion of value, a "honeypot" for hackers if they can crack it, but it has never been hacked in its entire history. Compare this to the uptime and security of any network (Visa, EFTPOS, NZ banks) run by a modern corporation and you won't find one with better uptime and security.

Another example of the discipline and expertise of the Bitcoin network was in 2021, when China enforced a ban on Bitcoin mining. At the time around 30% of the network's data centres were in China and these quickly came off line, as was visible on the public bitcoin network. The network continued to function without missing a beat, not a single block or transaction failed, all with the backdrop of 30% of the network being pulled offline at very short notice.

Since then the hash power (which represents the security and settlement assurances of the network) has relocated to other parts of the world and increased over 300% from 2021 levelvs. All this happened due to market incentives and without coordination by a central party. Only possible on a truly decentralized system.

How would Amazon, Google or any of New Zealand banks function if 30% of their servers were taken offline at short notice? The Cloudstrike incident in 2024 bought global corporations and travel to a halt, but Bitcoin kept running.

Over the years Bitcoin has proven and will prove again that its decentralization is a strength and allows it to provide a better monetary network than any "modern corporation with discipline and expertise". This is proven by people making the choice of moving their savings (which represent their time, effort and work) into a superior money.

Damien continues to say that Bitcoin only remains valuable because new people continue to be induced to invest. I'd like to ask him to show an example of "new people being induced to invest in Bitcoin?". And then the claim that a rival could know Bitcoin off it's perch:

"If a rival was successfully created, one that offered what the coin originally promised, this new product would impact the market as effectively as Microsoft Explorer killed Netscape and the iPhone made Blackberry junk."

Again, a reminder that Bitcoin is not a product, it's a protocol and a network. If the only thing that's required to kill Bitcoin is something that is better than Bitcoin, where is it? It's been 16 years...Bitcoin operates in a free open market and its code is open source, so anyone could (and many have tried) to make a better Bitcoin and all have failed. Examples of this are Ethereum, which tried to offer more programmability than Bitcoin, or the Bitcoin "forks" of 2017 & 18, which tried to improve Bitcoin's transaction capacity by creating a competing coin using the same open source code. The market has delivered a clear response to these challengers, they have failed to gain more adoption than Bitcoin.

What any open market advocate would love about Bitcoin is that it's a free and open market, which anyone can participate in at any time. The market decides which money is best, and the market is choosing Bitcoin and as long as that remains the case then Bitcoin is here to stay. If the market chooses another money, then Bitcoin loses and deserves to lose. But after 16 years and $2 trillion of value, every day Bitcoin continues getting stronger and stronger.

The innovation of Bitcoin was to create digital scarcity on an immutable ledger backed by energy, something we have never seen before. No one has invented a better internet, or better electricity, they're zero to one developments that can't be replaced by competitors.

"Bitcoin has failed in its central task; to become money. It is useless for the payment of anything other than a ransom."

We wonder on what basis Damien made this assumption? He mentions having tried to use Bitcoin later in the article but having failed. Were you trying to pay a ransom? If Bitcoin is useful for paying ransoms it must be money, which means it is also useful for paying for other things.

Bitcoin is a peer to peer payment protocol, anyone with a smartphone can join the network or send and receive payments. Bitcoiners all over New Zealand (and the world) make Bitcoin payments for goods and services every day.

Things have changed in the last few years and we wonder if Damien is aware of the Lightning Network, a payment layer which operates one layer up from the Bitcoin main chain? Lightning is fast, easy to use and allows instant payment and settlement of transactions denominated in the sub unit of bitcoin, called sats.

If you want to find Bitcoin merchants near where you live, take a look at btcmap.org. Or come to a Bitkiwi meetup and buy a beer with bitcoin, it's really easy.

Buy beer with Bitcoin at a Bitkiwi meetup

In my own life, there are merchants where I live who accept Bitcoin and I pay them for goods and services I need regularly. These are regular NZ owned businesses like cafes, food growers, restaurants, hairdressers and medical professionals. Many online retailers and services (like AI agents, VPN services, or Email Providers) accept Bitcoin. As a native digital currency, bitcoin allows micropayments much smaller than is possible with Credit Cards or Paypal. You'll also find prices in Bitcoin are going down over time, this is the benefit of holding hard money.

Interesting examples of other platforms using Bitcoin payments are Fountain.fm and Wavlake, apps where you can tip or stream bitcoin micropayments to the podcast host or artist. This is creating a whole new economy known as "value for value" and is giving content creators the ability to earn directly from their work, without Spotify or YouTube gating the content and taking a cut.

The largest peer-to-peer bitcoin marketplace in the world right now is a protocol called Nostr, which is an open decentralized messaging protocol. Think of an open protocol like Twitter / X, but without permissioned entry and verified accounts, with the ability to send money to anyone else on the network instantly. This is not a concept, it's live and real today and there are 1.8 million people on this protocol zapping sats back and forward to each other as you read these words.

Your own articles could be published on top of Nostr and you could receive micropayments from supporters who find value in your work. No account approvals, no merchant accounts, no paywalls, no chargebacks, just value directly to you with instant settlement and minimal fees.

"Its volatility makes it worthless as a unit of exchange and it retains some utility as a store of value so long as people believe in it."

The statement here "retains some utility as a store of value so long as people believe in it" reminds me of Adrian Orr's quip last year "Central banking is a great business, you print money and people believe in it". Whether its fiat currency or Bitcoin, money does require belief to be successful and it's the money with the strongest properties of money which will gain the most belief and trust, therefore being adopted by people.

Good money must do several things to be successful, and the hardest money always wins (Gresham's law).

Store of Value - Bitcoin is clearly winning this compared to all fiat currencies, which Damien acknowledges in his article too, so we're on the same page here.

Medium of Exchange - Bitcoin is monetizing in an organic way, so there are swings up and down. This is due to the fact that it's a truly free market open 24/7 with no barriers to entry and a fixed supply. Anyone can buy or sell bitcoin at any time they like and as the supply is fixed and protected by the decentralized nature of Bitcoin, when increases or decreases of supply happen the price can change quickly. As bitcoin's adoption increases the volatility will decrease.

Bitcoin is a bottom up protocol which is challenging the world's largest currencies, as it monetizes over time it is natural to expect volatility. As Bitcoin monetizes it passes through these distinct phases, from collectible to store of value to medium of exchange to unit of account. We're at the Store of Value and Medium of Exchange phase now for Bitcoin.

"And a better product will emerge because Bitcoin has demonstrated how large the market is."

Bitcoin's success has proven that there's a use case for it, as Damien acknowledges here, so the only thing that is needed to beat Bitcoin is to be a better Bitcoin? Not sure of the logic here, it's like saying the internet isn't perfect but because it's so large and dominant as a communication protocol it proves the case and a better option will come along and take the crown.

Bitcoin is only in the position it's in today because it has proven its monetary properties and people have decided they value these properties better than the alternatives, so have made the decision to hold it.

Damien even kindly outlines what the successful challenger requires, we'll talk through each of these separately.

"The new thing will need three attributes. It must be easy to use. I’ve tried to use Bitcoin and failed. Anything that requires a week’s training and lacks a help-desk is going to struggle."

When did you try to use Bitcoin? And what happened? Bitcoin wallets are now widespread and widely available for use on mobile and desktop. If you're willing to try, we'd be happy to show you how to make a Bitcoin transaction and if you can't do it in under 5 minutes the beer's on us.

Come join us at a meetup, there's one in Auckland soon. We're always happy to show people how to make their first Bitcoin transaction. It doesn't take a week. Lots of the wallets that operate know do offer help and support, as do the many open sourced communities around the world. But as a protocol (like the internet), Bitcoin itself doesn't have a help desk, just like the internet doesn't have a help desk.

"Second; it must be stable. Commerce requires predictability and most crypto currencies aren’t; which makes them worthless for business."

Stable, like what? The NZD? This is what makes commerce and life so difficult for people now, the only "predictability" of fiat currency is that it will buy less and less every year. As a money with a fixed supply, Bitcoin offers stability, one Bitcoin is always one bitcoin, what changes is the amount of fiat currency required to buy one as it's constantly getting debased.

"And finally it needs widespread acceptance."

Bitcoin is an open network and protocol, anyone on the planet with access to a smartphone and an internet connection can join without any approval or authorization from a third party. If we want money to be widely accepted, do we want a network which anyone can join at any time, or a network which requires ID, verification and the constant gatekeeping by third parties?

Bitcoin is a paradigm shift which represents the opportunity for everyone in the world to be on the name monetary network with the same rights and rules applying to everyone. Surely this is a better basis for widespread adoption than one controlled by corporations or governments?

"Bitcoin remains viable because it lacks a credible rival; and so long as that remains the case it will continue to draw in those seeking to profit from the bigger fool theory and true believers."

You're right, Bitcoin is only viable because it lacks a credible rival. If the government, or a private entity, can offer money which does a better job than Bitcoin then it will win. But if Bitcoin continues to credibly enforce its monetary properties, people will continue to choose it over fiat.

Bitcoiners aren't here for profit seeking, we're here to hold the value of our life's work in something that doesn't leak our energy with inflation. We don't want to get rich quickly, but we want to avoid getting poor slowly, because that's what is happening to all of us on fiat.

"Bitcoin lacks this inherent base so when someone invents that better blockchain mousetrap there will be a rush to the new thing and a USD three trillion dollar asset class will evaporate."

Damien starts to wind up now, with a surprising claim that money needs the inherent base of a government to tax from. How does this line up with the "libertarian perspective" in your profile?

And he winds up with this:

"Well. That is my theory; which I confidently predicted in January 2018 and, well, seven years later it hasn’t happened, and which I will confidently predict in seven years hence. If necessary."

Seeds of doubts already? What if there is something about Bitcoin that you don't understand yet? Wouldn't you want to try and find out why this thing just keeps growing and more and more people are beginning to understand why?

It's about the money Damien, our current money is broken and Bitcoin offers a better alternative. Much better.

And yes, if you're holding good money you may be surprised to see that your purchasing power goes up, that's what money is supposed to do. We're so conditioned to living with poor money that the idea of money holding its value or even increasing in purchasing power over time is so foreign that most people dismiss it.

Bitcoin is better money and it's designed to hold and increase your purchasing power. We don't call that profit, we call it storing the value of your life's work, a better money is better for everyone.

Come visit us at a meetup, you might be surprised to find out there's more to Bitcoin than you think.

Article by: KiwiBitcoinGuide

Recommended Reading

Gradually, then Suddenly. A Framework for understanding Bitcoin as money. by Parker Lewis